- Russia's credit ratings were downgraded to 'junk' by Moody's and Fitch on Thursday.

- Moody's and Fitch both downgraded Russia 6 notches following S&P move earlier in the week

- Russia's ruble has plummeted and its banks have isolated as Western sanctions mount over the Ukraine war.

Russia's credit ratings were downgraded to junk by Moody's Investors Service and Fitch Ratings Thursday, underlining the economic risk to the country from the sanctions imposed by Western powers after it attacked Ukraine.

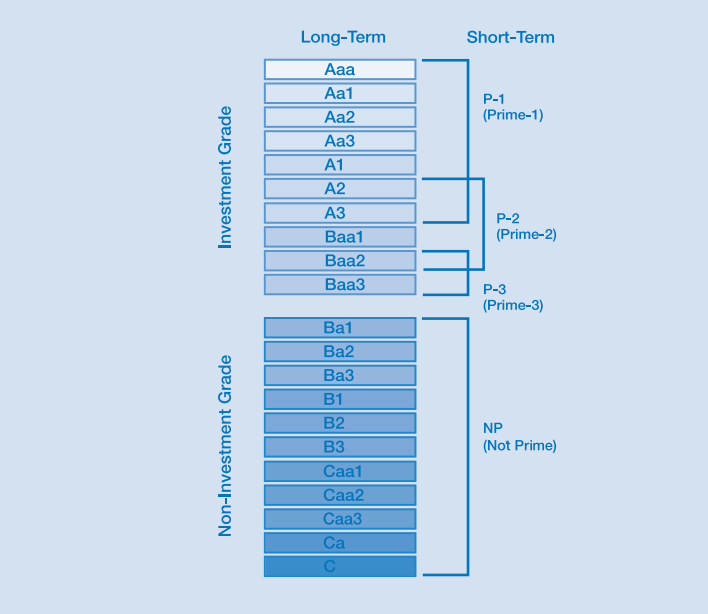

Both agencies reduced their ratings for Russia's credit by six notches, signaling they see a high risk of a default. Moody's now puts Russia at B3, from Baa3 previously, and Fitch went to a single-B rating from BBB — an adjustment from ratings that were already low grade.

"The multi-notch downgrade of Russia's ratings and maintaining the review for further downgrade were triggered by the severe sanctions that Western countries have imposed on Russia, including the sanctioning of the Central Bank of the Russian Federation and some large financial institutions," Moody's said in a statement.

The US and its allies have imposed increasingly tougher sanctions on Russia since its troops attacked Ukraine a week ago, aimed at hampering its trade and financial capacities.

"The severity of international sanctions in response to Russia's military invasion of Ukraine has heightened macro-financial stability risks, represents a huge shock to Russia's credit fundamentals and could undermine its willingness to service government debt," Fitch said in a statement.

The US has brought in restrictive measures to prevent the Russian Central Bank's ability to use its international currency reserves in ways that undermine the impact of sanctions.

At the weekend, Western allies disconnected selected Russian banks from SWIFT, the key messaging network that underpins the global payments system. The country's biggest bank, Sberbank, closed its European arm Wednesday after the European Central Bank said it was headed for failure.

"We now anticipate widening of these measures to other banks, limiting such mitigants, with large costs through severe short-term disruptions and more lasting constraints to the efficiency of executing transactions." Fitch said.

A contributing factor in the downgrade was the heightened risk of disruption to sovereign debt repayments, Moody's said.

For Fitch, the key rating drivers included the likelihood of lower GDP growth and increased volatility due to the ongoing sanctions and the ruble's rapid depreciation.

Russia's currency, the ruble, has been in free-fall since the invasion, and Moscow's stock exchange was shuttered for a fourth straight day Thursday. International investors have fled Russian assets, and multinationals have dropped their Russia-related investments.

The Moody's and Fitch downratings mean all three top ratings agencies see Russian credit as junk, after S&P Global Ratings cut its rating last week, as the invasion of Ukraine began.

Further US sanctions targeting Russian oligarchs and their companies are in the works, a source familiar with the matter told Reuters. On Wednesday, President Joe Biden said "nothing is off the table" when asked whether the US would ban Russian oil and gas imports.